Margin Of Safety Formula Stocks

Self Sustainable Growth Rate SSGR being higher than current sales growth. But the purpose of a margin of safety is not just to protect your rate of.

Margin Of Safety Ratio Definition Explanation Formula And Examples Accounting For Management

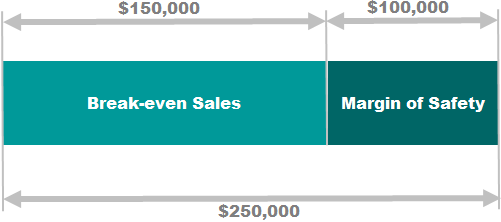

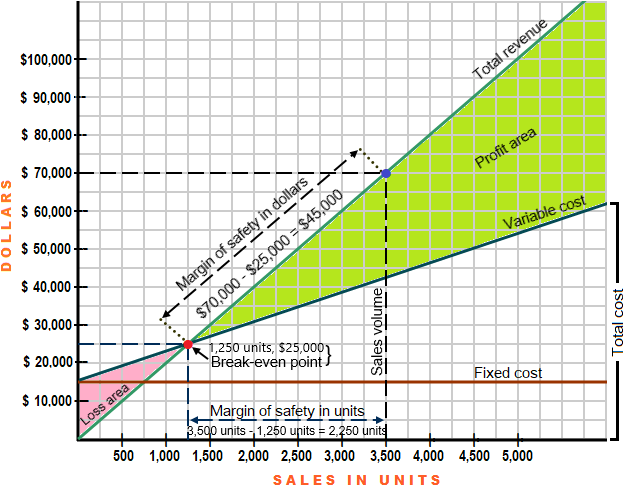

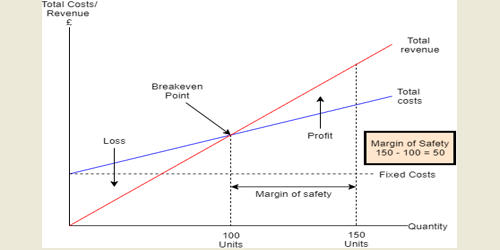

The safety formula interval is equal to the current sales minus the breaking point the parts of the current sales.

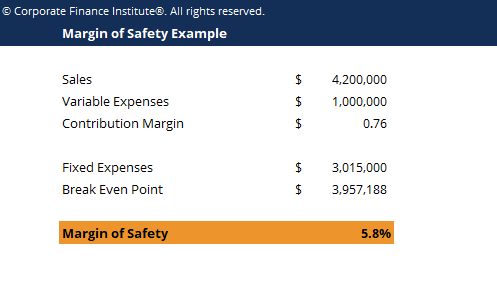

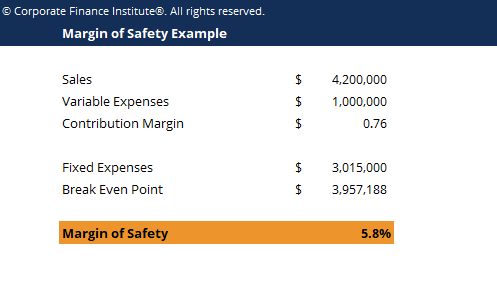

Margin of safety formula stocks. For margin of safety the bigger the better when buying stocks. Margin of Safety in Accounting As a financial metric the margin of safety is equal to the difference between current or forecasted sales and sales at the break-even point. The Margin of Safety Formula To find the Margin of Safety you first need to find the Sticker Price of a business and its stock.

The margin of safety is a ratio measuring the gap between sales and break-even point or the difference between market value and intrinsic value. The margin of safety is. The formula for margin of safety is.

This metric the single most significant valuation metric in our arsenal. Currentestimated sales and break-even point. Positive Free Cash Flow FCF after meeting entire capex.

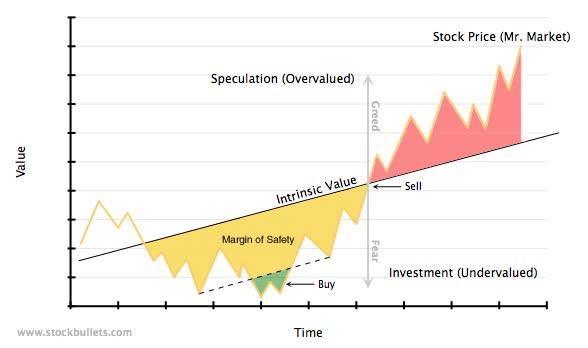

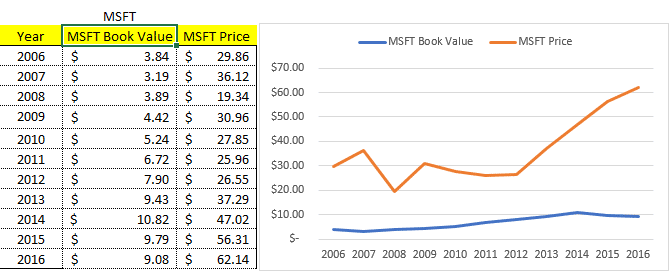

How Does Margin of Safety Work. Let us assume that the book value per share of a company is 10 but the market price of one share is. How to Calculate the Margin of Safety Ratio.

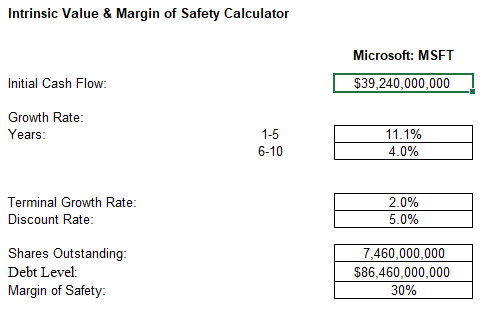

It is the final output of our detailed discounted cash flow analysis. Margin of Safety 1 - Stocks Current Price Stocks Intrinsic Value. If you are interested in buying shares of a company or even an entire business you will want to estimate the value of the cash it generates into the future.

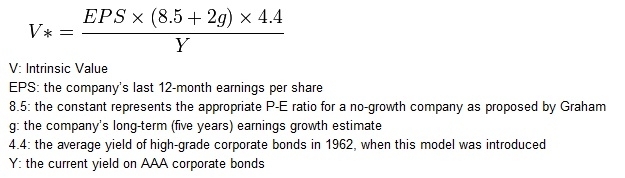

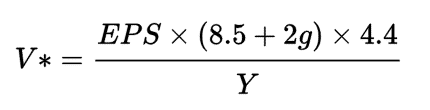

That term was first made popular by Benjamin Graham in his bestselling The Intelligent Investor and later on as the main topic of a book by Seth KlarmanFor the individual investor trying to beat the market its imperative to craft your own margin of safety formula that aligns with the. In order to evaluate the Sticker Price you want to find the Future Growth Rate the PE Ratio and your Minimum Acceptable Rate of Return. Buying stocks with a discount to intrinsic value is also commonly referred to as a margin of safety.

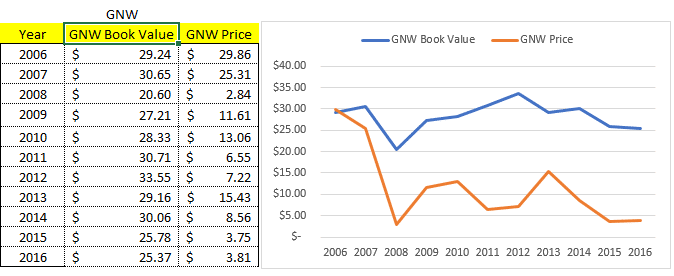

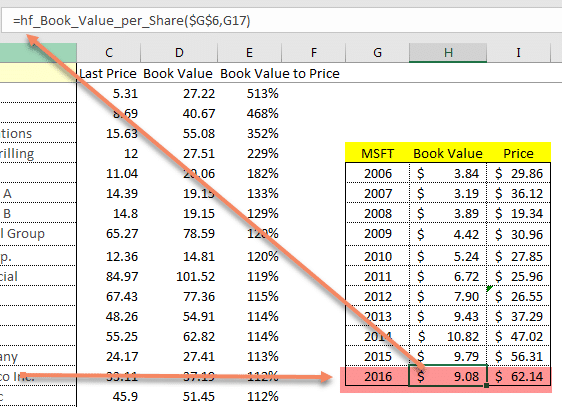

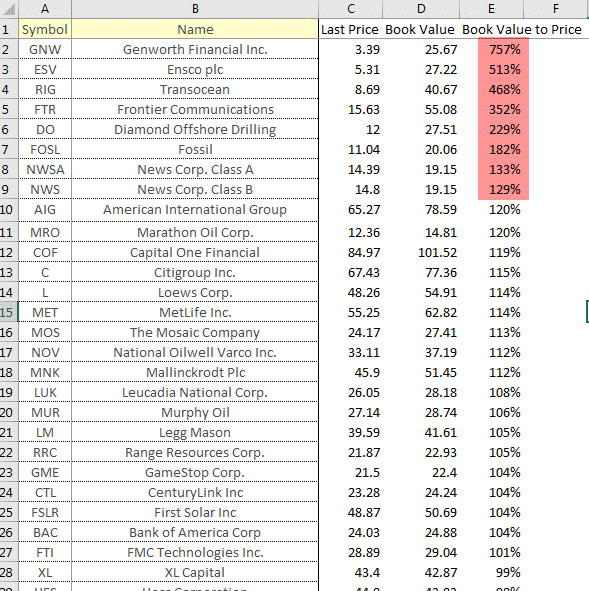

In other words the total number of sales dollars that can be lost before the company loses money. So now we will do this margin of safety analysis of stocks for the whole of SP 500 and find out the ratio of the book value to the stock priceSo we calculate the ratio and then sort the table in descending order of the ratio. Margin Of Safety Analysis Of Stocks With Formula In Excel.

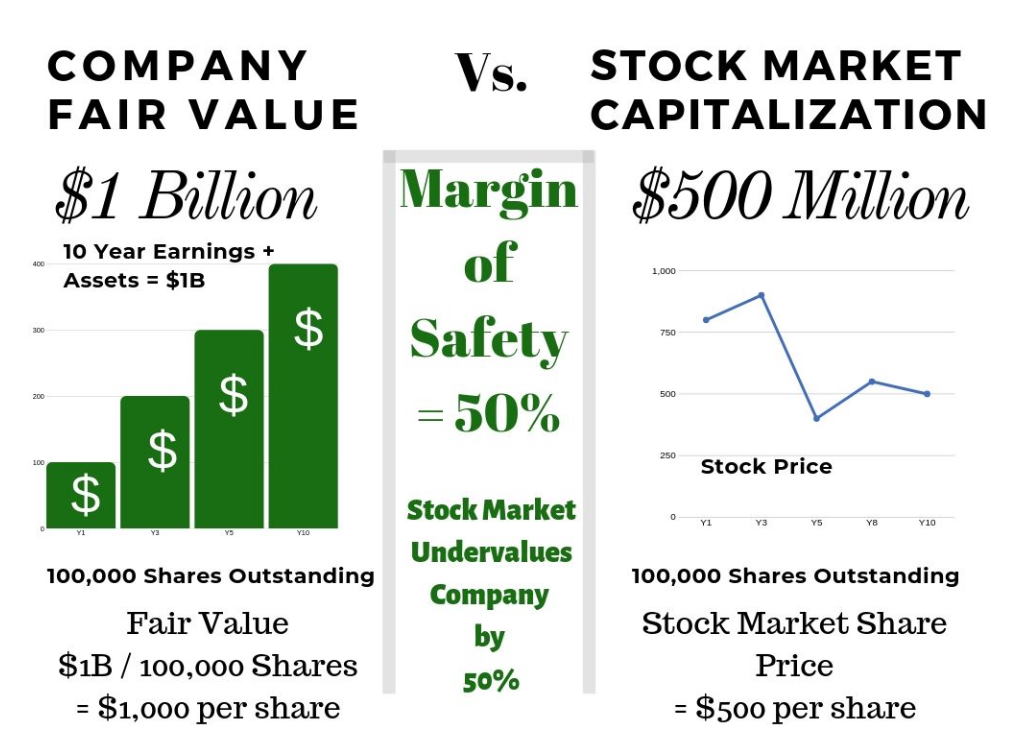

Margin of Safety is the percentage difference between a companys fair value and its current stock price. In accounting the margin of safety is calculated by subtracting the break-even point amount from the actual or budgeted sales and then dividing by sales. Margin of Safety Intrinsic Value Per Share Stock Price Intrinsic Value Per Share.

The result is expressed as a percentage. Margin of Safety Formula. B Margin of Safety in the business of the company.

If you assume that a company liquidates as on today then what will be the value of one share. Margin of Safety 1 Current market priceintrinsic value Margin of Safety 1 6080 025 x 100 25 As the current market price moves closer or farther away from the intrinsic value it will raise or lower the margin of safety. Value investing or dividend investing may often be thought of as conservative investing methods and this may be true in many cases.

The formula for margin of safety requires two variables. Margin of Safety Current Sales Level Breakeven Point Current Sales Level x 100. Margin of safety is the amount by which a companys shares are trading below their intrinsic value.

Simple Steps to assess Margin of Safety in a Stock A Margin of Safety in the purchase price. Earnings Yield being higher than 10 years bond Government Securities yield. The Margin of Safety Formula Equation FVx Net cash flow inflow or outflow for the j th period for the initial Present cash flow x 0 d Discount Rate Annual rate of interest or Inflation p Number of periods to be included.

The margin of safety formula is calculated by subtracting the break-even sales from the budgeted or projected sales. Margin of safety formula stocks The safety interval is the difference between the expected level of profitability and the breaking point. This formula shows the total number of sales above the breakeven point.

Margin of safety analysis of stocks Book value per share. There are two applications for setting the safety interval1. A Margin of Safety BOOSTS Returns Rather than Just Providing Protection.

How To Use A Margin Of Safety When Investing Dividend Monk

Breakeven Unit 3 Topic 3 2 3 Aims

Intrinsic Value And Its Relationship To Margin Of Safety Arbor Asset Allocation Model Portfolio Aaamp Value Blog

Margin Of Safety Analysis Of Stocks With Formula In Excel With Marketxls

Margin Of Safety Analysis Of Stocks With Formula In Excel With Marketxls

Margin Of Safety Concept Importance

Calculate And Interpret A Company S Margin Of Safety And Operating Leverage Principles Of Accounting Volume 2 Managerial Accounting

Margin Of Safety Formula Calculator For Stocks Xl Download

Margin Of Safety Buffett Graham S Magic Formula Explained

Calculating Intrinsic Value With A High Margin Of Safety Seeking Alpha

Margin Of Safety Buffett Graham S Magic Formula Explained

What Is The Margin Of Safety Fincash

Margin Of Safety Ratio Definition Explanation Formula And Examples Accounting For Management

Margin Of Safety Analysis Of Stocks With Formula In Excel With Marketxls

Margin Of Safety Analysis Of Stocks With Formula In Excel With Marketxls

Margin Of Safety Template Download Free Excel Template

Concept Of The Margin Of Safety Assignment Point

Margin Of Safety As The Central Thesis Behind Value Investing

Post a Comment for "Margin Of Safety Formula Stocks"